Credit Reports: How to Pull Your Credit Report and What to Look For

Most of us have heard about credit scores, but are you familiar with credit reports? Your credit report shows all the lines of credit that are currently open under your social security number. As a result, it provides a current picture of car loans, credit card debts, home mortgages, and any other loans. Additionally, it shows the payments you have made on those loans, whether payments were made on time, and the remaining loan balances.

Why is my credit report important?

Now that you understand the basic information contained in your credit report, why should you care about it? First, whenever you apply for a new loan, creditors will pull your credit report to determine if you are creditworthy. In other words, based on your current debt and your repayment history, they will determine if you are a risky investment. In the eyes of creditors, you are an investment because they are counting on you repaying the balance, as well as making the interest payments. If you are unable to pay your loan, they will sell it to a debt collection agency at a fraction of the actual loan amount in order to recoup some costs. Even if you have no plans to take out a loan, checking your credit report regularly (at least 2-3 times per year) is a credit tool to quickly catch identity theft. If someone has managed to obtain enough of your personal information to open a revolving credit account or take out a loan, checking your credit report may be the only way you realize your identity has been compromised. Even if identity theft has not occurred, errors will occasionally appear on your report, such as a credit account that you never opened. In order to correct these deficiencies, you must submit a dispute to one of the three major credit bureaus – Experian, TransUnion, and Equifax.

How do I get my free credit report?

By this point you are probably convinced that it's a good idea to look at your credit report, but how do you get your hands on it? By law, each of the three major credit bureaus has to provide you with a free credit report every 12 months. Since you can get one copy from each of the agencies, my recommendation is to pull a report every four months. For example, if you pull your credit report from Experian in January, you could then pull a report from TransUnion in May and from Equifax in September. While numerous websites advertise "free credit reports," many of these sites are phishing for personal information. Therefore, you should only utilize the website recommended by the Federal Trade Commission: http://www.annualcreditreport.com/

How do I read my credit report?

Once you pull your credit report, the next step is to interpret it. Each of your loans will appear as a separate entry with a brief description of the creditor to include the company's contact information (address and phone number). The first action you will want to take is to review all the loans to ensure there are no credit accounts that you did not open. If there are, you will need to file a dispute. In order to do this, you can go to any of the three credit bureau websites. Once you file a dispute with one of them, the other two agencies will also be notified.

Let's assume you have reviewed all the creditors listed on your credit report and there are no fraudulent accounts, the next step is to look at the payment history. Each entry will contain a list of your payments by month and whether they were late or on time. Any late payments reflect negatively on you as a borrower and will bring down your credit score. As such, it's important to pay your bills on time.

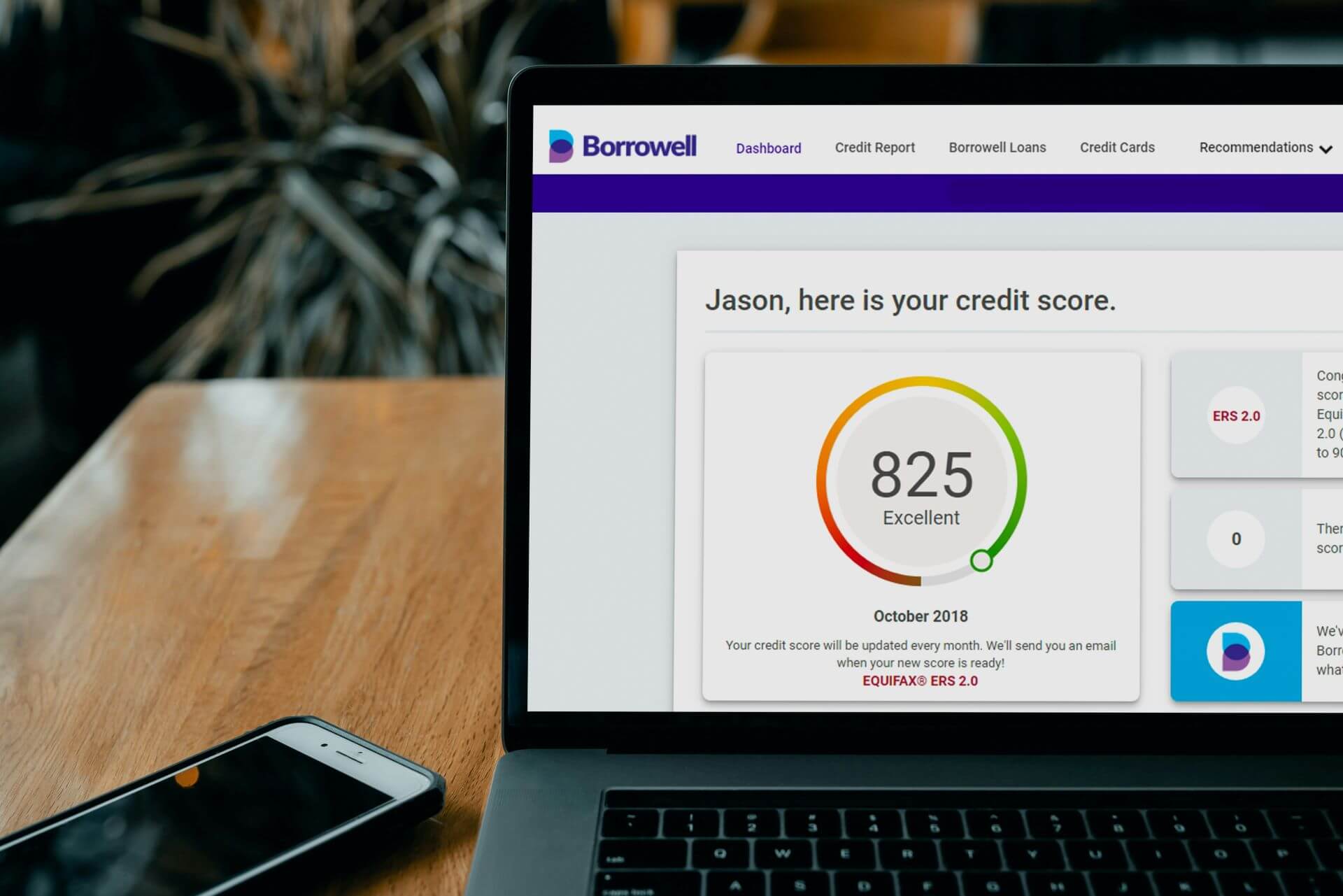

At this point, you have all the basic skills required to pull your credit report and interpret it. Pulling your free annual credit report from each of the three credit bureaus will ensure you know exactly what information is being reported to lenders when you request a loan or credit card, as well as help you identify inaccuracies or fraudulent accounts. If you haven't already, you should also check out our article on credit scores.