Credit Scores

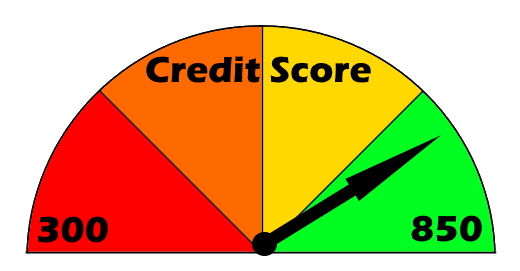

If you have a credit card, car loan, mortgage payment, or any other debt, you also have a credit score. This score, as well as your credit report, is used by lenders to determine whether you are creditworthy and the risk associated with lending to you. Depending on where you get your credit score, the score may change. The three major credit bureaus – Experian, TransUnion, and Equifax – all offer credit scores; however, each one is calculated slightly differently. So how do you know which one to use? The score most lenders will rely on when determining your creditworthiness is the FICO score. Fortunately, we know what factors are used to calculate this score and those factors are what you need to focus on to increase your score. FICO scores range from 300 to 850. The higher the number, the better.

1. Pay on Time

The biggest factor that is going to impact your credit score is paying on time. Late payments will quickly bring down a credit score, so ensure you are always making your monthly payments. The easiest way to accomplish this is to set up automatic payments. By doing this you will eliminate the possibility of forgetting a payment. If you miss too many sequential payments, then you will receive notification that the debt will go into collection status. You want to avoid this at all costs. If for some reason you have missed several payments and are unable to make your minimum payments, call the creditor. It is possible to work out a revised payment plan. Remember, creditors want you to repay your debts. If they sell your debts to a collection agency, the debt is sold at a significant discount, and the creditor loses money.

2. Keep Your Balances Low

Another important factor for raising or maintaining a high credit score is not carrying a high balance on your credit cards. Your credit score consideration the amount of credit you are utilizing. For example, if you have a card with a $7,000 credit limit and one with a $3,000 credit limit, the total credit available to you is $10,000. Therefore, if you were carrying a balance of $2,000, you would be at 20% utilization ($2,000 divided by $10,000). In order to maintain a low utilization rate, you can either pay down the balance on your cards or request an increase in your credit limit. Keep in mind that requesting an increase will likely result in a hard credit inquiry, which will hurt your credit score (see paragraph 4). The general rule of thumb is to keep your utilization below 30%, so try to stay below this benchmark when possible.

3. Build a History

Your credit score is also influenced by the length of your credit history. The longer and more extensive your history, the higher your score will be. Your history will consider the length of time your oldest account has been open and the average amount of time all your accounts have been open (if you have multiple accounts). While there is not much you can do about your average, it is important not to needlessly close credit accounts, especially your oldest. Closing any accounts will decrease your average credit age; however, if you are paying high annual fees, it may be in your best interest to close the account. In general, I highly discourage opening any credit card accounts that charge an annual fee. Ultimately, you will have to weigh the pros and cons of paying an annual fee or taking a hit on your credit score by closing the account.

4. Limit Credit Applications

There are two types of credit inquiries – hard inquiries and soft inquiries. The type you need to be concerned with is hard inquiries, as these will reduce your credit score. Soft inquiries can be made without your request or authorization. For example, a creditor may run a soft inquiry to screen you prior to sending a credit card offer. In contrast, hard inquires can only be made with your authorization. For example, if you apply for a credit card, you give the creditor permission to run a hard inquiry. This inquiry will stay on your credit report for two years, after which it will fall off and no longer impact your score.

5. Obtain Multiple Types of Credit

The final factor influencing your FICO score is credit diversity. Creditors like to see that you can handle different types of credit, such as a personal loan and a credit card. Therefore, if you have a mix of different credit accounts, it will positively impact your credit score. That being said, this factor has the least amount of impact on your credit score, and you can still have an excellent score with a very limited number of accounts. Therefore, I do not advise opening up additional accounts that you do not need simply to increase your account diversity. Only open what you need.

Conclusion

Now that you know the five factors influencing your credit score, it is time to utilize your new knowledge. Remember, credit is not bad if you utilize it correctly. Building credit is important because it gives you the ability to obtain a loan or line of credit. Whether or not you plan to utilize credit, keeping it in your toolbox gives you greater security and flexibility. We would love to hear how you have been able to apply our advice to increase your credit score, so be sure to share your success with us on Facebook or Instagram.